Financial Obligation Buying Property: Opportunities in New York City

Property investment offers a range of methods for producing returns, and one often-overlooked approach is financial obligation investing. In New york city, with its dynamic and diverse real estate market, debt investing has actually ended up being an significantly appealing option for investors looking for stable earnings and lower danger contrasted to equity investments. This guide will certainly discover the basics of debt investing in real estate and why New york city offers a one-of-a-kind landscape for this investment strategy.

What is Financial Obligation Purchasing Real Estate?

Financial obligation investing involves borrowing capital to realty developers or homeowner in exchange for normal rate of interest settlements. Investors essentially work as the lender, moneying tasks through lendings protected by property as collateral. If the debtor defaults, the capitalist can recover their investment by asserting the home.

Trick Features of Debt Investing

Foreseeable Returns: Normal rate of interest settlements give a steady earnings stream.

Reduced Threat: Investments are safeguarded by the underlying residential or commercial property.

Shorter Time Frames: Lots of financial debt financial investments have shorter durations contrasted to equity financial investments.

Why Consider Debt Investing in New York Realty?

New York's realty market uses a wide range of possibilities for financial debt capitalists due to its dimension, diversity, and resilience. Here are some reasons to concentrate on the Realm State:

1. High Property Demand

From New york city City's deluxe apartments to upstate multifamily homes, need genuine estate continues to be solid. This makes certain regular chances for debt financing as programmers and homeowner look for financing.

2. Diverse Market Segments

New York's realty market covers domestic, commercial, and mixed-use developments, allowing capitalists to expand their portfolios within the state.

3. Secure Collateral

Properties in New York commonly hold high worth, supplying robust collateral for financial debt financial investments. Even in economic declines, realty in this state has a tendency to recover promptly.

4. Accessibility to High-Quality Projects

New York is home to several reputable programmers with massive, profitable tasks. Partnering with knowledgeable developers lowers the danger of defaults.

How Financial Debt Investing Functions in New York City

1. Direct Loaning

Investors give fundings directly to programmers or property owners. This prevails for personal tasks or smaller-scale advancements.

2. Real Estate Financial Obligation Funds

Signing up with a debt fund enables investors to merge resources and financing numerous jobs, lowering individual threat.

3. Crowdfunding Systems

Systems focusing on realty crowdfunding make it possible for financiers to join debt investing with smaller sized capital outlays.

Benefits of Financial Obligation Buying New York

1. Constant Capital

Investors get normal interest repayments, making it an eye-catching option for those seeking secure income.

2. Lower Volatility

Unlike equity financial investments, financial debt investing is less affected by market variations, supplying even more foreseeable returns.

3. Protected Investments

Realty acts as security, reducing the danger of overall resources loss.

4. Green Springs Capital Group Easy Investment

Financial obligation investing requires less energetic monitoring contrasted to possessing and maintaining residential properties.

Obstacles of Debt Investing in New York Real Estate

While financial obligation investing provides many benefits, capitalists need to recognize possible challenges:

1. Rate Of Interest Danger

Changing rates of interest can influence the returns on fixed-income financial investments.

2. Market Saturation

Particular locations in New york city might be oversaturated, causing boosted competition among investors.

3. Legal Intricacies

New York's realty market operates under strict regulations. Investors have to make certain conformity with state and government regulations.

Trick Locations for Debt Financial Investment in New York City

1. New York City City

Emphasis: High-end domestic developments, commercial property, and mixed-use jobs.

Advantages: High residential or commercial property values and international need.

2. Long Island

Focus: Suburban housing developments and retail rooms.

Benefits: Growing population and closeness to NYC.

3. Upstate New York

Emphasis: Multifamily residential properties, trainee housing, and commercial areas.

Benefits: Budget friendly residential property prices and arising markets.

Tips for Effective Debt Buying New York

Study the marketplace: Understand the need, residential or commercial property worths, and advancement trends in certain areas.

Analyze Customer Reputation: Make Sure the borrower has a solid track record and financial stability.

Review the Collateral: Validate the residential or commercial property's worth and potential resale potential customers.

Diversify Your Profile: Spread financial investments across numerous projects and regions to decrease danger.

Collaborate with Experts: Work together with lawful and financial consultants familiar with New York's real estate market.

Financial obligation investing in property is a compelling technique for creating steady income with minimized threat, especially in a robust market fresh York. The state's varied property Green Springs Capital Group landscape, high demand, and secure property worths make it an superb option for financiers wanting to expand their portfolios.

Whether you're brand-new to debt investing or an experienced capitalist, New york city offers chances to attain consistent returns and monetary safety. Discover this financially rewarding market today and benefit from one of the most trustworthy financial https://greenspringscapitalgroup.com/ investment approaches in property.

Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Andrew McCarthy Then & Now!

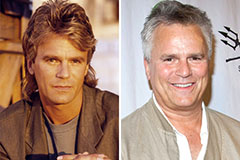

Andrew McCarthy Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!